The Short‑Term Outlook for the US Economy

Column Published in syndication April 10, 2024The US economy continues to defy the expectations of many, gaining jobs at a surprising pace given the challenges that seem to pop up constantly. Barring a major setback, we should see the expansionary pattern continue (possibly with some bumps along the way). Here's a brief look at my latest projections for the US economy and factors affecting likely performance.

- Tags:

- short-term outlook,

- US economy

What is the future real estate commission structure likely to look like?

Radio Spot Broadcast via Texas State Networks on April 10, 2024Dr. Perryman dicusses the future of real estate commissions and the real estate market for buyers and sellers.

- Tags:

- commissions,

- real estate

Homebuying

Column Published in syndication April 03, 2024The National Association of Realtors (NAR) recently settled a major federal lawsuit. The primary issue was the compensation to buyers' real estate agents required for homes listed on NAR's multiple-listing services (MLS). While there was the potential for negotiation, most transactions tended to play out according to the default arrangement, with the buyers' and sellers' agents splitting a 6% commission.

- Tags:

- commissions,

- real estate

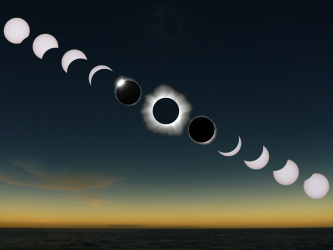

How much economic impact will the solar eclipse have on the US economy?

Radio Spot Broadcast via Texas State Networks on April 05, 2024Dr. Perryman discusses the economic impact of the solar eclipse.

- Tags:

- economic impact,

- eclipse,

- United States

Will the bridge collapse in Baltimore have much impact on the US economy?

Radio Spot Broadcast via Texas State Networks on April 03, 2024Dr. Perryman discusses the economic implications of the bridge collapse in Baltimore on the US.

- Tags:

- US economy,

- bridge collapse

Eclipse Economics

Column Published in syndication March 27, 2024Get ready for a big show (where you literally see nothing) with a huge audience! On Monday, April 8, a total solar eclipse will cross North America, passing over Mexico, the United States, and Canada. The path of totality (where the sun is fully hidden) enters Texas around Eagle Pass and crosses to the northeast, exiting near the northeast corner. About 12 million Texans reside in the path of totality, which includes the major metropolitan areas along the I-35 corridor.

- Tags:

- economic benefit,

- eclipse,

- Texas

What did the Fed do regarding interest rates at its recent meeting?

Radio Spot Broadcast via Texas State Networks on March 28, 2024Dr. Perryman discusses the recent Fed meeting and expectations regarding interest rates this year.

- Tags:

- Federal Reserve,

- interest rates,

- inflation

The Economic Impact of the Solar Eclipse on the US and Affected States

Brief Published on March 28, 2024On Monday, April 8, a total solar eclipse will cross North America, passing over Mexico, the United States, and Canada. The path of totality enters Texas around Eagle Pass and crosses the nation to the northeast, exiting the northeast near Houlton, Maine. More than 30 million people reside in the path of totality (including about 12 million in Texas alone).

Where are the fastest growing counties in the US in population growth?

Radio Spot Broadcast via Texas State Networks on March 27, 2024Dr. Perryman discusses the fastest growing counties in the US in population growth and that 6 of the top 8 are in Texas.

- Tags:

- Texas counties,

- population change

4 Years Later

Column Published in syndication March 20, 2024Unlike most weeks in my frenetic schedule of projects, deadlines, speeches, and meetings, I remember that one well - Monday speech in Lubbock; flight to Dallas for afternoon meeting; all-day testimony in Dallas on Tuesday; Wednesday meeting in DC; Longview speech on Thursday; late afternoon flight for reception at our home. That was a pretty typical week, but it was followed by a year of being almost constantly at home with virtual work and all of the analysis, task forces, and other factors which accompany game-changing events. It was quite an adjustment from normally being on the road 250-300 days per year.

- Tags:

- COVID-19,

- economy,

- job losses,

- economic recovery